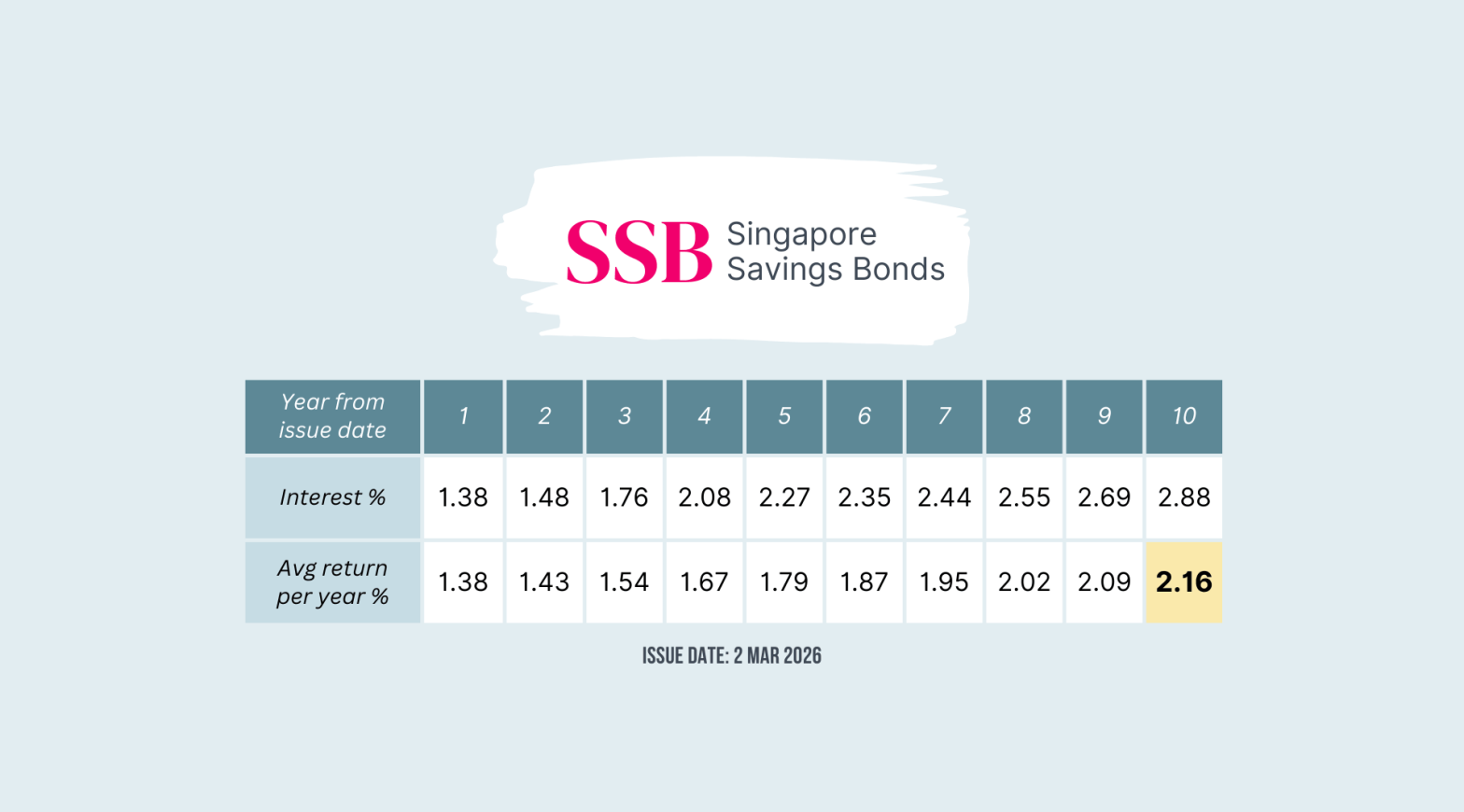

The latest offering for SSB Mar 2026 (SBMAR26 GX26030W) has been released: first-year rate of 1.38%, and 10-year average rate of 2.16%. Despite having a slightly lower 10-year average yield, this month’s SSB still offers respectable long-term rates above the 2% mark.

With the current rate-cut cycle underway, and interest rates anticipated to keep falling, is this SSB offering still a worthwhile consideration?

SSB Mar 2026 Details

Great news for fixed-income investors: this is yet another month of rates breaking above the 2% mark! The first-year rate is 1.38%, and the 10-year average rate is 2.16%.

Despite a recent minor bump in rates, investors should note that we are currently in a rate-cutting cycle. Given the expectation for inflation to ease, the trend of declining interest rates is likely to persist in the near future.

If you have yet to fill in your desired SSB allocation and are interested in this SSB Mar 2026 offering, please take note of the following application timeline:

| Opening date | 02 Feb 2026, 6pm |

| Closing date | 24 Feb 2026, 9pm |

| Allotment date | 25 Feb 2026, after 3pm |

| Issuance date | 02 Mar 2026 (by end of day) |

Competitiveness

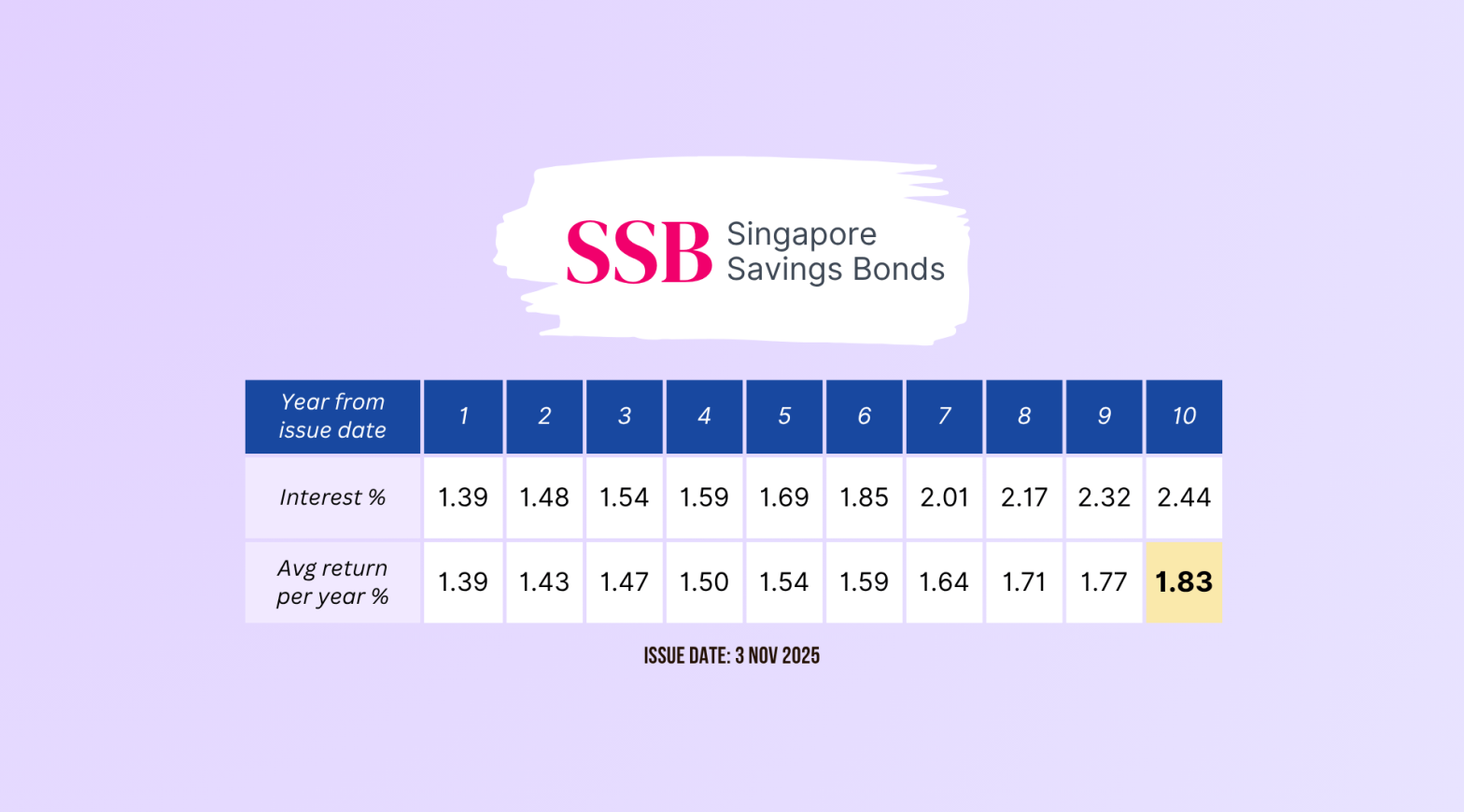

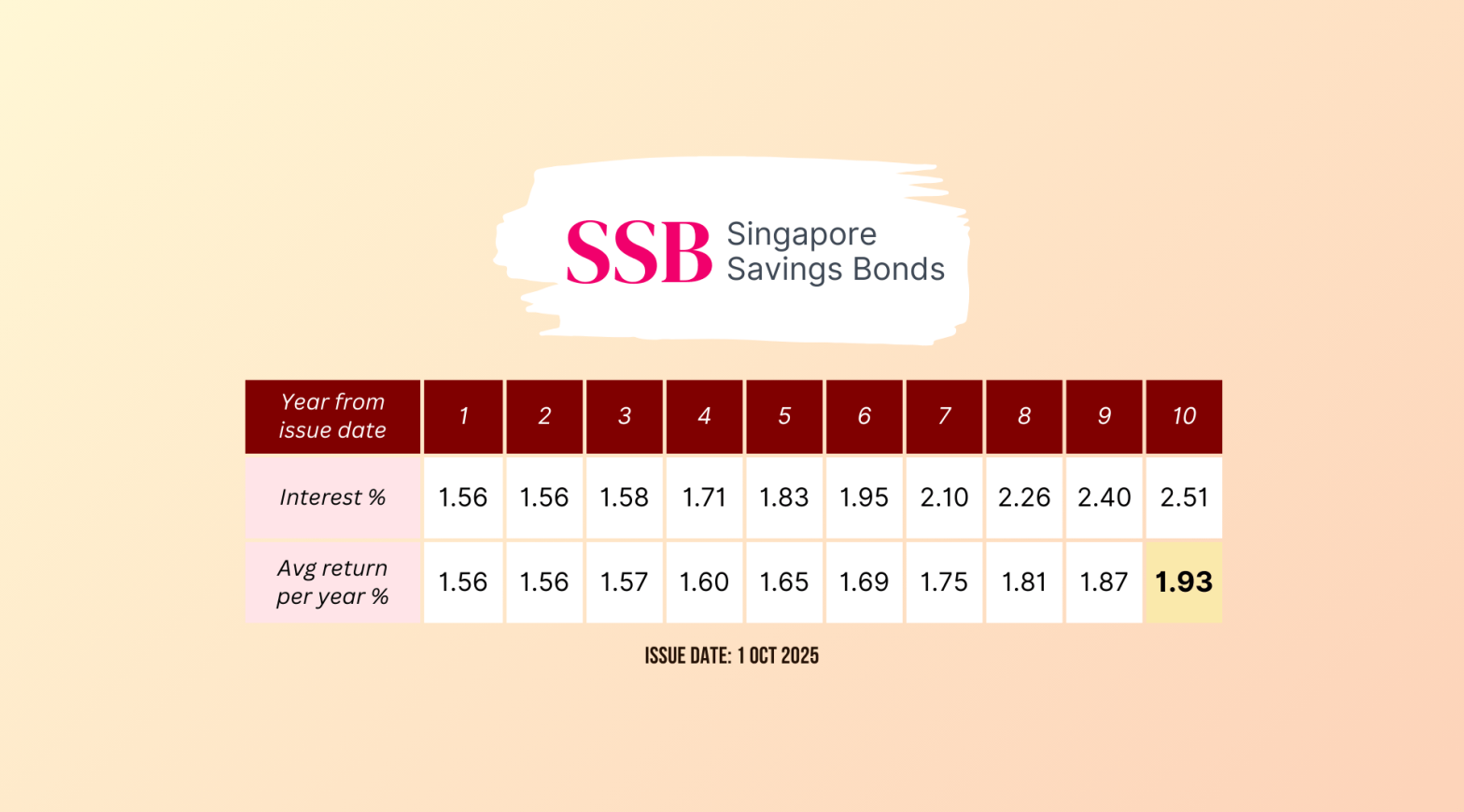

Let us look at whether the current SSB offering is competitive enough historically:

The chart above shows the historical SSB rates in the past few years. We can observe that this month’s SSB rates are much better than in recent months, but unfortunately, much lower than those in 2023-2024.

Futures Rates Projection

Although it’s impossible to project where rates will go with certainty, we can still make an educated guess about where interest rates will go in the near term by analyzing the latest rate projections from the Fed.

The Fed kept the interest rate steady in its latest FOMC meeting. The Fed also projected about one rate cut this year, with the timing contingent on incoming data to better assess market conditions.

The market generally agrees with the Fed, expecting up to two rate cuts this year.

Because SSB rates tend to follow these key benchmark interest rates, we can expect the SSB rates to decline following the pace of the rate-cut cycle.

How about next month’s SSB rates?

For the immediate next month’s rates, we can take a hint from the market movement of the 10-year Singapore government bond yield.

We can see from the chart that the yield has risen since late last year but has recently declined slightly. If the trend persists, we can expect next month’s SSB rates to be slightly lower. We can continue to monitor this yield movement as the month progresses to get a more accurate projection.

What Do We Do?

We love SSB because we can lock in rates for the next 10 years and still allow you to redeem monthly while earning accrued interest.

Because we believed interest rates would decline over the short to medium term, we have migrated all of our short- and medium-term cash allocations to SSB throughout 2023.

Given that the yield on our current SSB holdings is higher than the rate offered in this month’s SSB tranche, we will not be applying for this SSB Mar 2026 offering.

How about you? Will you be participating in this month’s SSB? If so, you may follow our step-by-step guide on how to buy SSB.