The three local Singapore banks DBS OCBC UOB have reported their Q1 2023 earnings. Their results were fantastic! With these banks at one of their most profitable positions ever, is it time to invest in Singapore banks’ stocks? Let us dive in!

DBS OCBC UOB Earnings Recap

With the banks collapsing in the United States and Europe, how did the Singapore banks perform this quarter? Well, they are solid! Let’s see the summary:

| DBS | OCBC | UOB | |

|---|---|---|---|

| Revenue (Growth YoY) | $4.94B (+34.1%) | $3.35B (+26.7%) | $3.52B (+49.4%) |

| Net Profit (Growth YoY) | $2.57B (+42.8%) | $1.88B (+38.6%) | $1.51B (+66.8%) |

| Net Interest Income (Growth YoY) | $3.27B (+49.6%) | $2.34B (+55.6%) | $2.41B (+42.9%) |

| Net Fees & Commissions Income (Growth YoY) | $0.85B (-4.5%) | $0.45B (-13.2%) | $0.55B (-3.5%) |

| Other Non-Interest Income (Growth YoY) | $0.81B (+35%) | $0.56B (+11.4%) | $0.56B (+457%) |

| Net Interest Margin (Growth YoY) | 2.12% (+0.07pp) | 2.3% (-0.01pp) | 2.14% (-0.08pp) |

| Return on Equity | 18.6% | 14.7% | 14.9% |

| Return on Assets | 1.41% | 1.63% | 1.25% |

| Non-Performing Loans Ratio | 1.1% | 1.1% | 1.6% |

As you can see, the three local banks did very well this quarter. They managed to keep growing their revenue and income year-over-year. This year is impressive, with the lowest revenue growth rate among the three at 26.7%. The net profit growth is fantastic, with the lowest growth from OCBC still at 38.6%. Let’s just say they passed with flying colors.

Regarding profitability, their Return on Equity (ROE) numbers is equally impressive, with DBS reaching >18%. The default rate is also healthy for all banks hovering around the 1-2% rate.

To summarize the earning results above in two words: record-breaking.

If you want to read the full earning results, you can read directly from DBS, OCBC, and UOB websites.

Market Headwind

All DBS OCBC UOB have been growing at an impressive rate, but the question is whether that growth rate is sustainable. Can you expect a 30%-50% YoY consistent growth rate for the foreseeable future?

Tail-End of Rate Hike Cycle

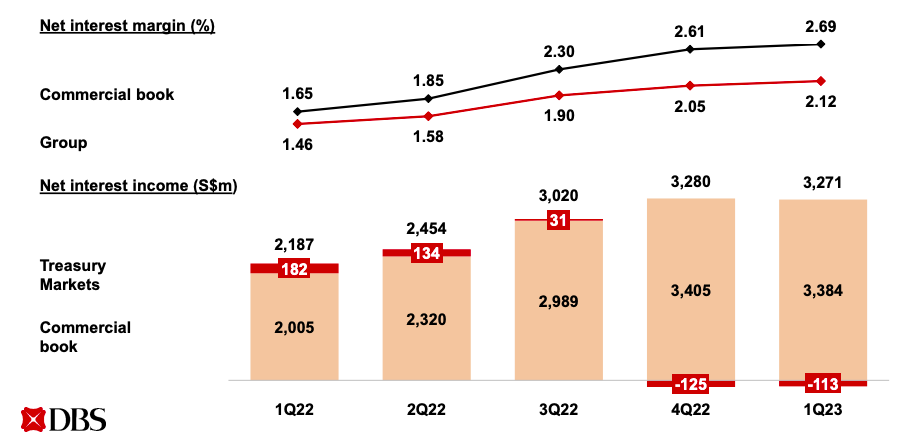

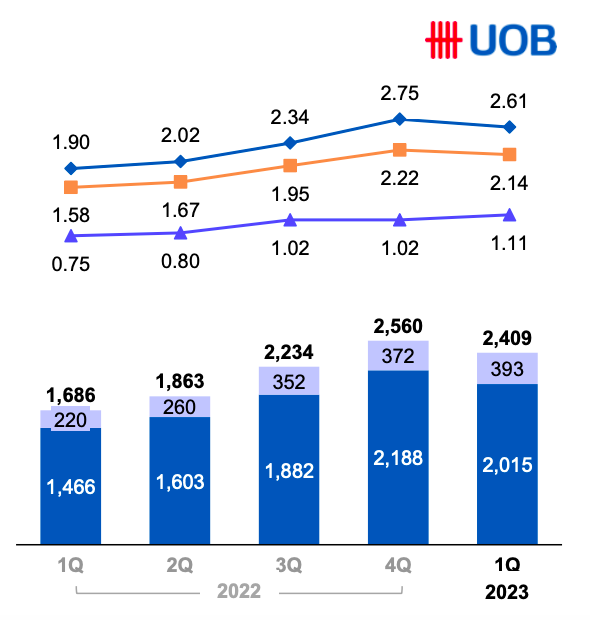

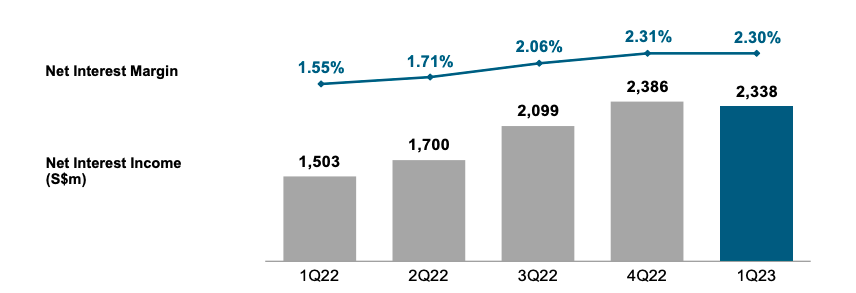

A significant income contributor for our local banks is the net interest income. The net interest margin has steadily climbed this past year as the Federal Reserve kept raising interest rates quickly. Net interest margin (NIM) is the difference between the interest the bank charges the borrowers and the interest the bank pays the depositors. As the interest rate hike cycle continues, the bank hikes the borrowing rates faster than the deposit rates; therefore, we see the NIM climbing steadily in 2022.

If you had been reading our macro economy coverages, you would have known that the Federal Reserve may have reached the tail end of its rate hike cycle. The bulk of the interest rate hike is likely to be behind us. As the Fed started holding the interest rate or cutting, the banks’ NIM may decline slowly.

The latest CFO earning statements (DBS, OCBC, UOB) have already shown a slowdown (and even a decline) in this NIM growth.

With the current macro situation, we think it is unlikely that they will be able to sustain the net interest income growth in the short term. As a result, this may slightly impact their earning bottom line. The good news is that the decline will likely be gradual as the Fed is also expected to hold the higher rates for longer and slowly pivot.

In the long run, it is a different story, and we believe all three local banks, DBS OCBC UOB, will be able to keep growing their business. Their historical performance so far has shown how they have always been able to grow their business consistently.

Global Banking Crisis

Many banks in the United States and Europe have failed in 2023 alone. Singapore banks have benefited from this banking crisis because of their perceived safety. More deposits have flowed into our local banks as the market continues to be uncertain.

Going forward, the severity of the ongoing banking crisis is still unknown. The impact could be minimal to the Singapore banks because of the more stringent requirement for Singapore banks and the well-established reputation and perceived safety. That said, investors should continue to monitor the possible escalation of this banking crisis and the potential spillover effect on our banks.

DBS OCBC UOB Valuation

Which of the three local banks is the ‘cheapest’? Here is the summary:

| DBS | OCBC | UOB | |

|---|---|---|---|

| Share price | $30.66 | $12.25 | $27.77 |

| Dividend Yield | 5.02% | 5.52% | 4.8% |

| P/B Ratio | 1.35 | 1.07 | 1.07 |

| P/E Ratio | 10.42 | 10.03 | 11.2 |

Most investors investing in our local banks are in for the dividend and price appreciation. If you see the dividend yield, you can see that OCBC currently yields the highest.

In terms of valuation, our go-to metric for bank stocks is the P/B ratio. From the P/B ratio, we can see that OCBC and UOB are currently the ‘cheapest.’ How does it compare historically?

The three local banks currently do not seem undervalued compared to their historical valuation. They are either fairly valued or slightly overvalued. As prudent investors, we ideally want to acquire shares when they are undervalued (or at least fairly valued). However, please also note that this opportunity is not easy to come by with Singapore banks.

Nonetheless, all three local banks, DBS OCBC UOB, seem to be solid choices for investors who want exposure to the Singapore banking sectors with good dividend yield and potential share price appreciation in the future. However, with the macro headwinds ahead in the short to medium term, investors should exercise prudence when investing in banks. Happy investing!