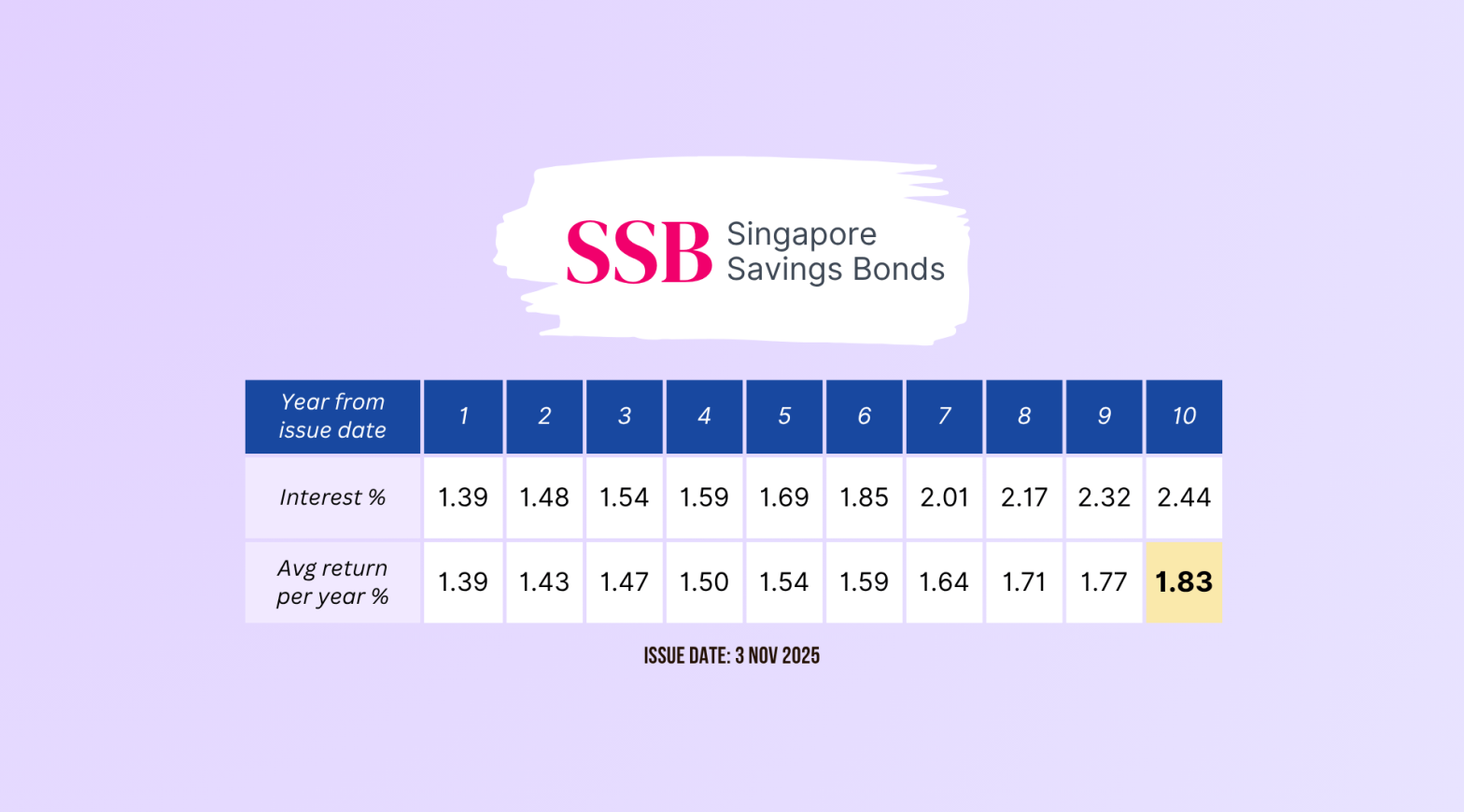

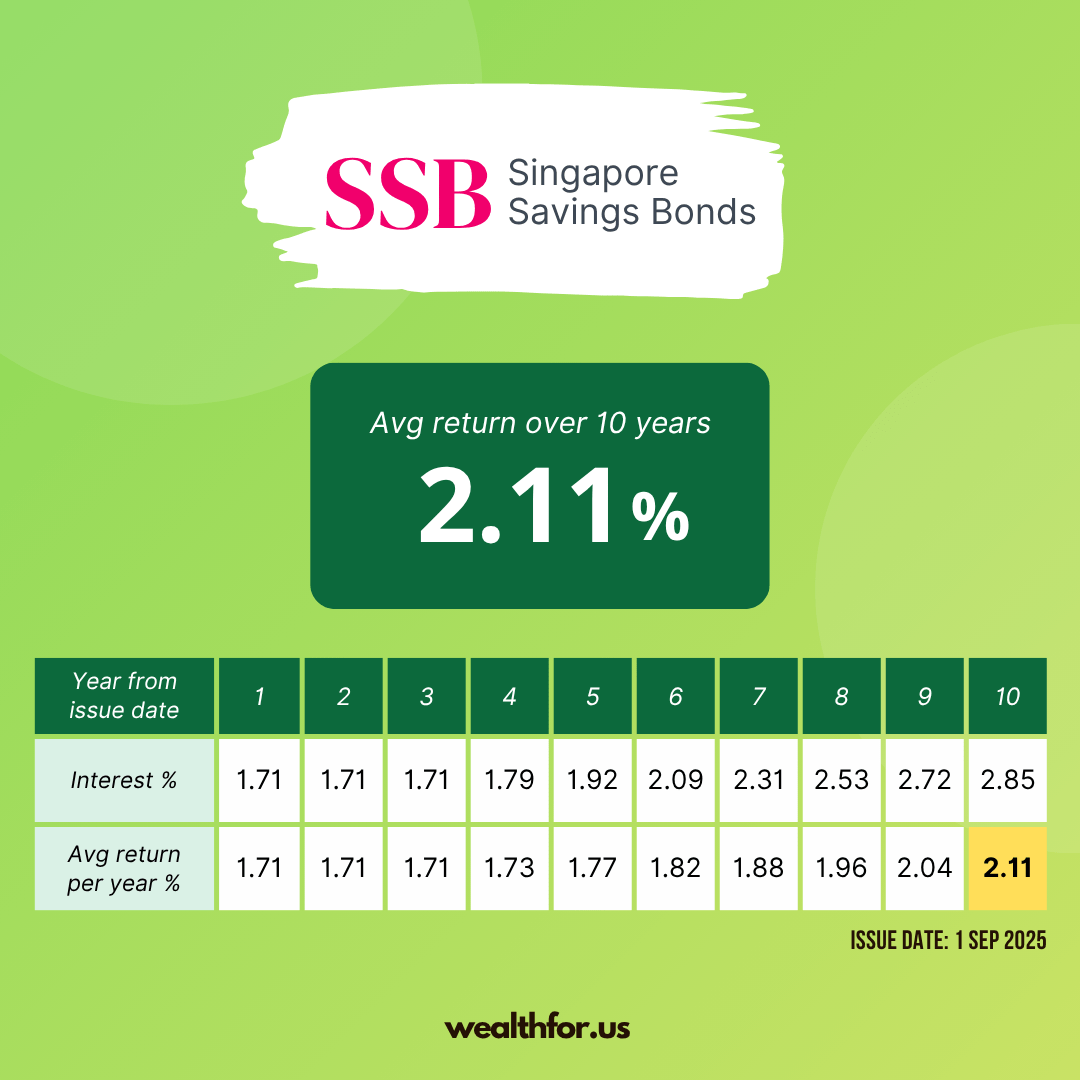

MAS has released the latest issue of SSB Sep 2025 (SBSEP25 GX25090A), featuring the first-year rate of 1.71% and the 10-year average rate of 2.11%. The rates are lower than the previous month’s SSB offering. Unfortunately, the trend of lower rates continues and will likely continue given that we are already in a rate-cut cycle. Should we consider this month’s SSB?

SSB Sep 2025

Many investors are probably disappointed with these SSB Sep 2025 rates. The first-year rate of only 1.71% and the 10-year average rate of 2.11% are relatively lower compared to the previous issuances. With the trend of lower rates likely to continue due to the rate cut cycle, we may see a further downtrend in SSB rates in the coming issuances.

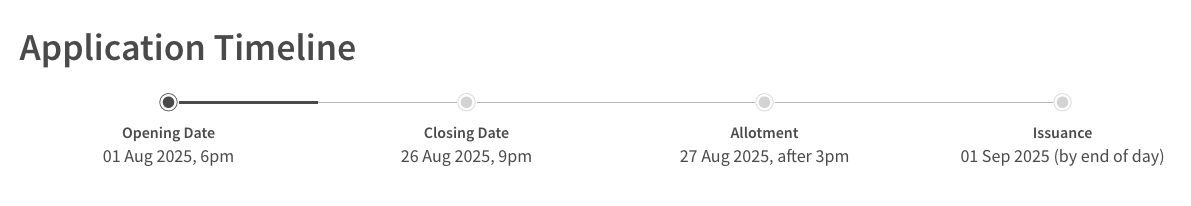

If you have yet to fill in your desired SSB allocation and are interested in this month’s offering, please take note of the following timeline:

Competitiveness

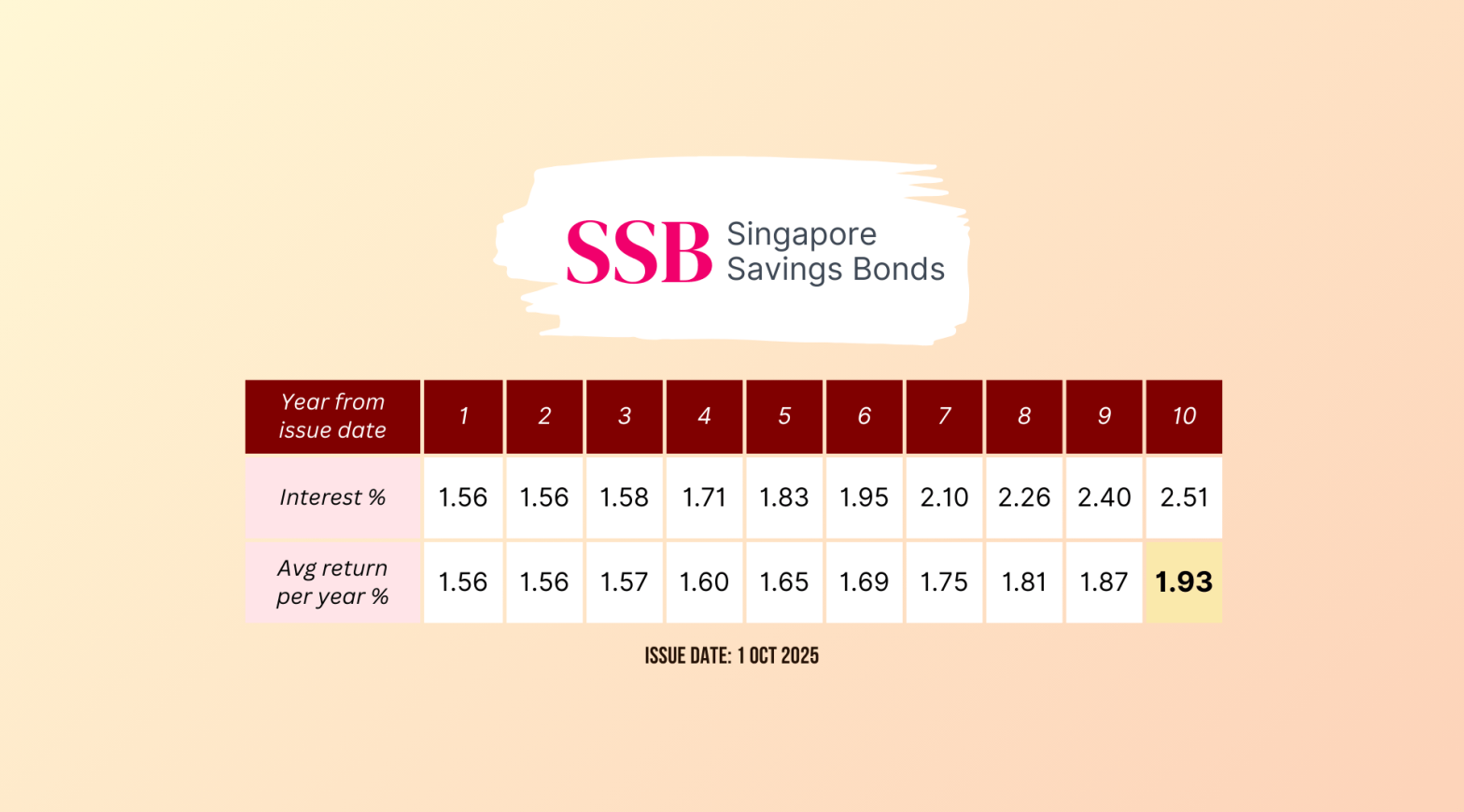

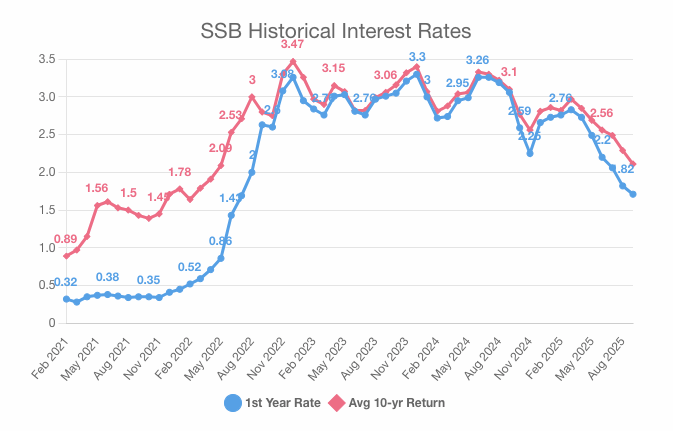

If you have been following the SSB rates over the past two years, you may have noticed that the current rates are significantly lower than those we used to see. Here are the historical SSB rates:

The chart above shows that the current SSB Sep 2025 rates are the lowest since mid-2022. Yes, that’s right, we last saw these rates around three years ago! Based on these data, we can safely say that the current rate is, unfortunately, not competitive compared to those in recent years.

How about future rates? Let’s try to look into where rates may go in the future.

Future Projection

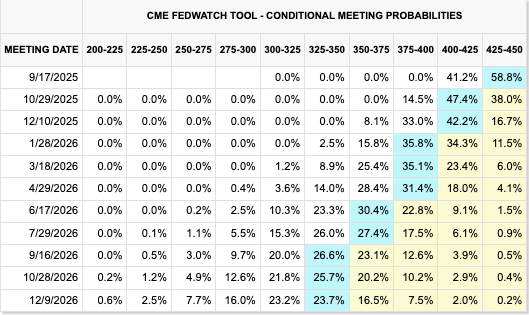

We can estimate future rates by following the projections the Fed published. From their latest FOMC meeting, they held the rates steady, favoring the wait-and-see approach, and keeping both options open for their next September FOMC meeting. Regardless, should there be no black-swan event, there is a higher chance for a rate cut in the coming months than a rate hike.

The market also generally agrees with the sentiment, by expecting one rate cut for the remainder of this year:

If these projections are correct, over the long term, we can also expect that SSB rates will decline roughly following the pace of these cuts.

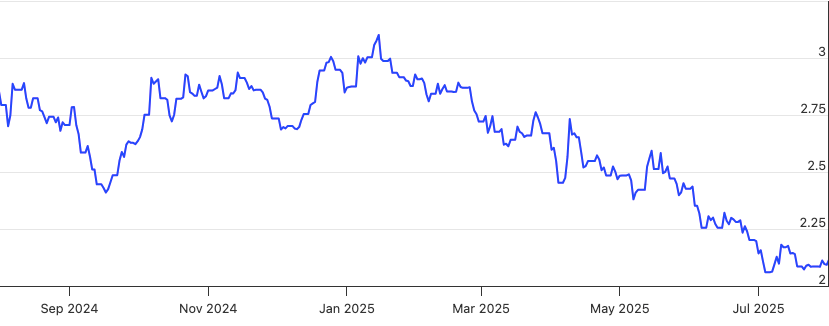

In the immediate short term, we can look at the Singapore government’s 10-year bond yield to estimate where SSB rates will likely be for the subsequent month’s issuance:

The chart shows the historical 10-year Singapore government bond yield. We can see that the bond yield has been on a downtrend recently and has started to plateau. Because SSB rates tend to track these bond yields, should this trend persist, we can expect the next month’s SSB rates to hover around the same level as the current SSB Sep 2025 rates.

As we are still at the beginning of the month, there could be further movement on the bond yield throughout this month, so please take this guess with a grain of salt 🙂

What Do We Do?

We love SSB because it offers the flexibility to withdraw every month without penalty, while still earning the accrued interest. Therefore, SSB feels more like a short-term bond, but with the ability to lock in the higher rates for 10 years.

We have been parking our short- to medium-term cash into SSB and have been optimizing the rates over the past two years. Because the rates of our SSB holdings are already higher, we will not be participating this month.

Will you be applying this month? If so, follow our step-by-step guide on how to buy SSB.