The latest T-bill auction for BS24105X has concluded, with the cut-off yield declining slightly to 3.78%. This is a decent result, as the yield is competitive enough compared to other fixed-income alternatives. Let’s look into the auction result.

Auction Summary

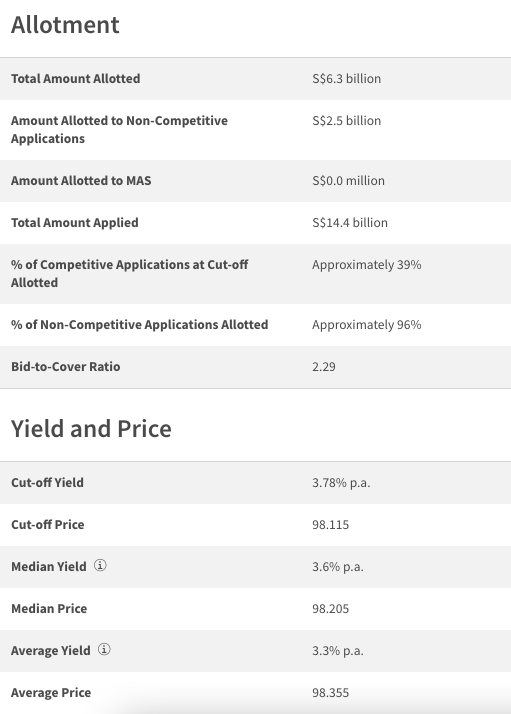

Here is the T-bill BS24105X auction summary:

Demand Jumped

This T-bill BS24105X auction saw a significant jump in the total application amount from $12.4 billion to $14.4 billion. That was $2 billion more application demand—wow! The higher demand could be attributed to the jump in the cut-off yield from the previous auction, thus incentivizing investors to park their cash into T-bills. No surprise, with the cut-off yield hovering around 3.7-3.8%, we can say that the yield is very competitive considering the low-risk profile of T-bills.

It is also worth noting that we hit the non-competitive bid cap this time, with non-competitive bidders only getting 96% of their desired allocation. The non-competitive bid amount has been trending very close to the allocation limit in the past several auctions, and we continue to see this trend in this latest auction. Given this trend, we will likely stick with competitive bids in the following auctions to ensure we can get our desired allocation.

How Competitive Is The Current Yield?

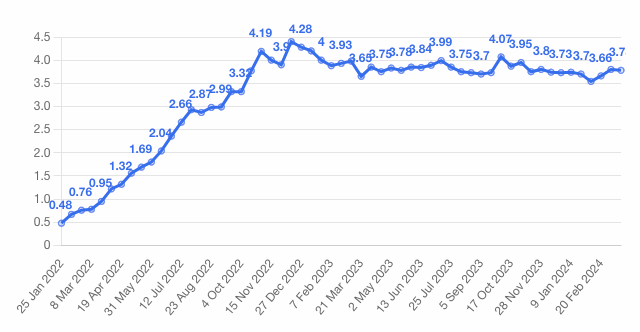

Although the yield declined slightly to 3.78%, it is still one of the highest recently.

The chart shows that the yield has remained in this 3.6-4.0% range throughout 2023 and 2024. The trend of this relatively higher yield is still intact. However, this trend may only continue for a while as the interest rate may reverse soon this year. The Fed and the market expect interest rates to start reversing toward the latter half of this year. If you agree with their assessments, you may see that this yield of 3.78% is quite competitive.

Alternatives

In short, the latest T-bill BS24105X, with the 3.78% yield, trumps most alternatives.

The most obvious alternative is fixed deposits. As of this writing, CIMB offers the highest 6-month fixed deposit rate at 3.35%. You can get up to 3.4% if you are their preferred customer. For the 12-month duration, DBS offers the highest rate at 3.2%. Whichever you choose, the rates are far from the 3.78% offered by T-bills.

Another strong contender for T-bills is the cash management accounts, specifically those with guaranteed returns: Syfe Cash+ Guaranteed and StashAway Simple Guaranteed. Syfe Cash+ Guaranteed and StashAway Simple Guaranteed offer guaranteed returns of 3.8% and 3.6%, respectively, over six months. Pretty decent! However, please note that your principal is not insured with cash management accounts, as these are considered investments.

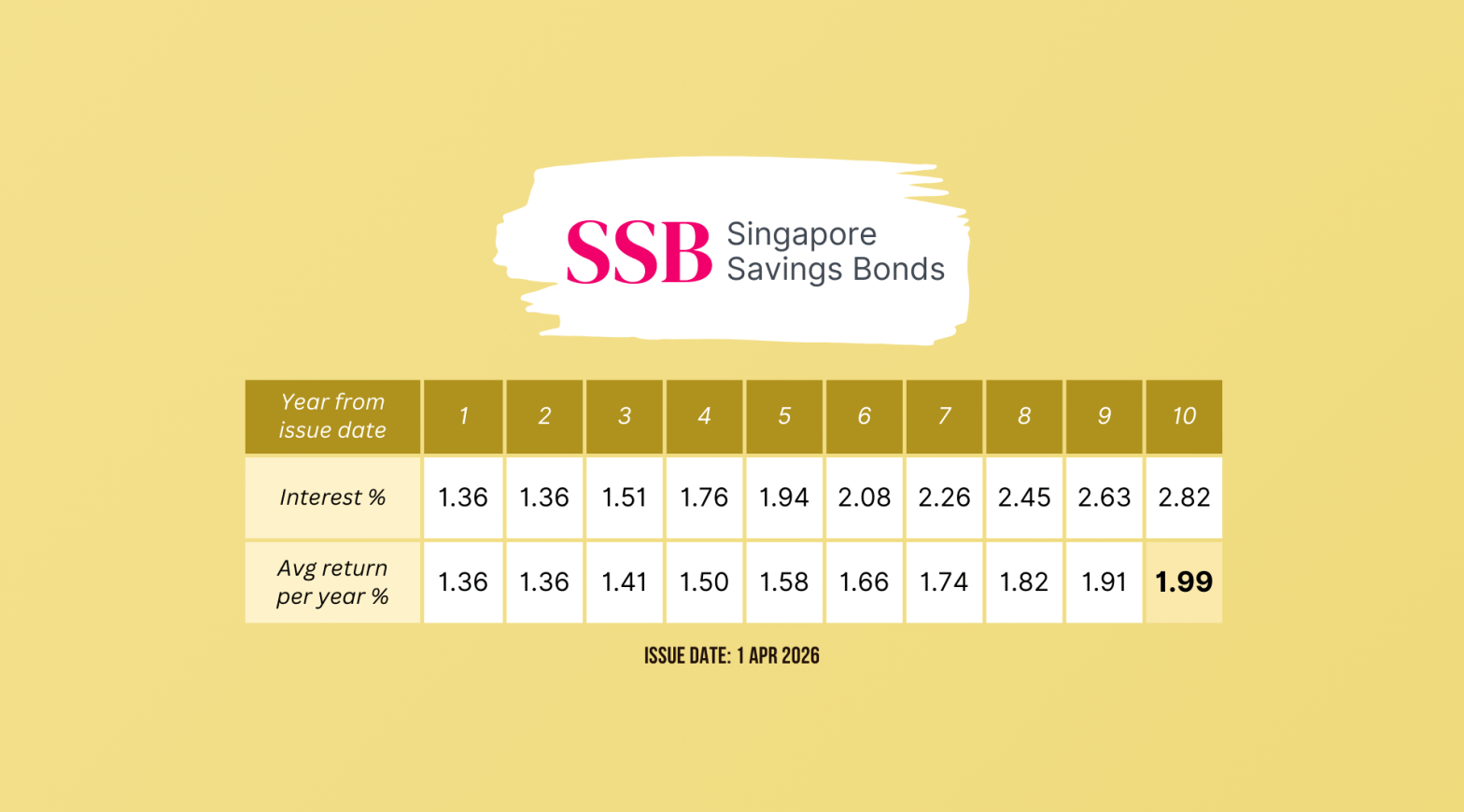

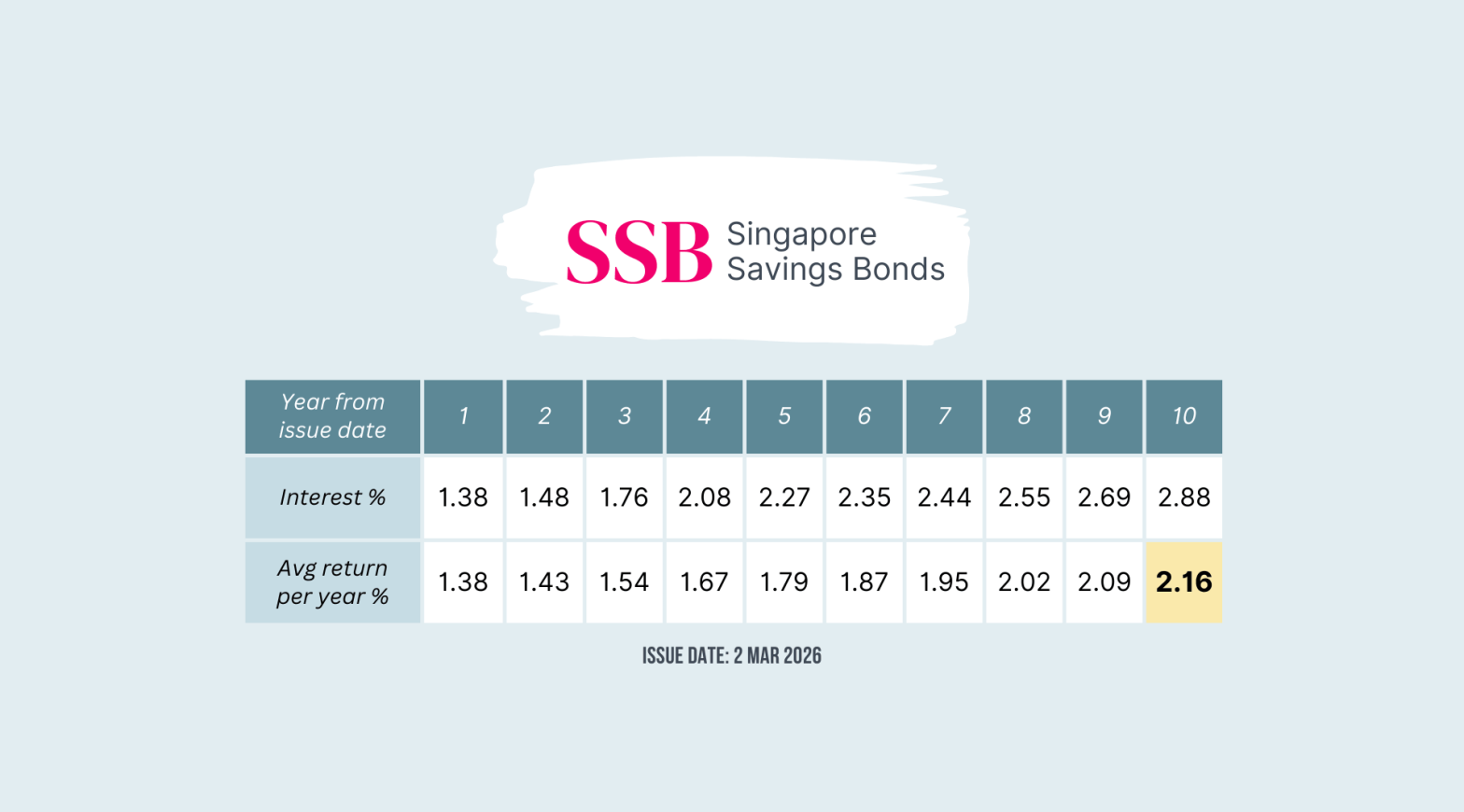

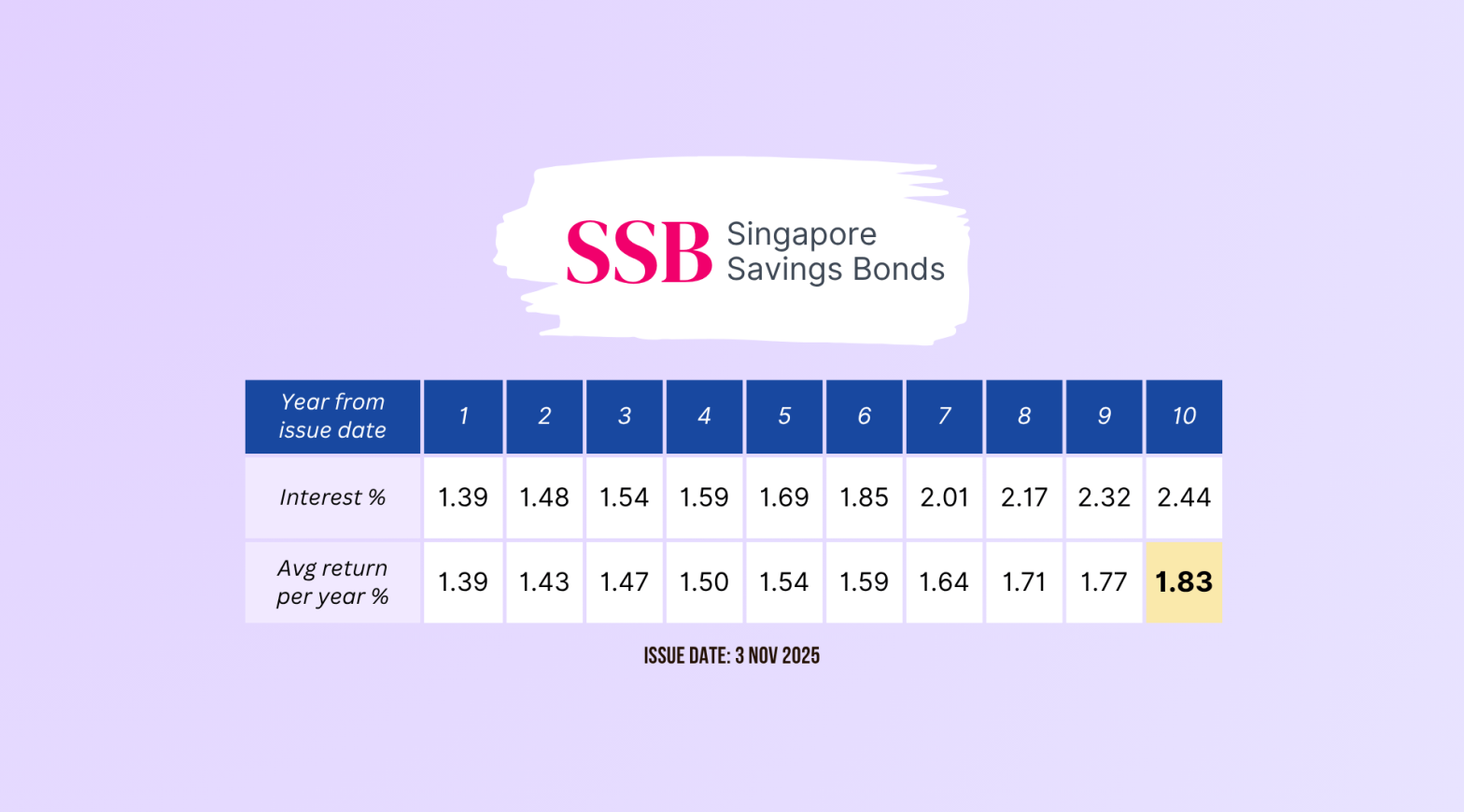

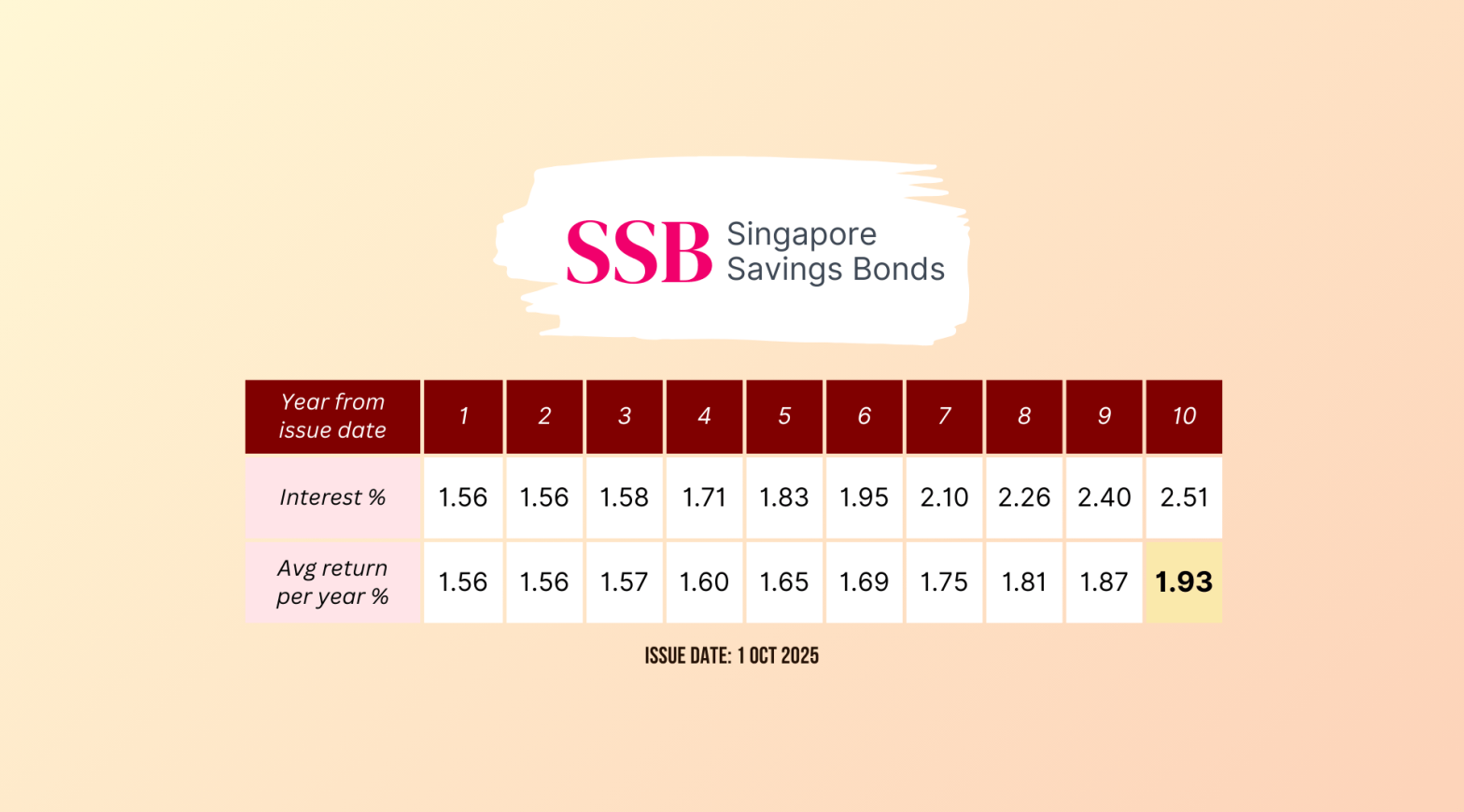

Alternatively, the Singapore Savings Bond (SSB) has garnered attention again lately as its interest rates surpass the 3% threshold. The latest SSB offering yielded a ten-year average rate of 3.04%. Although it is much lower than T-bills, SSB allows investors to lock in the rates for ten years, which is suitable for investors who want to lock in the higher rates for longer.

What Would We Do?

We are satisfied with this auction result as the yield stayed resilient. We have utilized T-bills to park our short-term cash to enjoy higher yields. However, with the likelihood of interest rate reversal coming this year, we have migrated some portions of our short-term cash into SSB to lock in the higher rates for longer. With SSB, we can lock in the rates for the next ten years while allowing enough flexibility to redeem every month.

If you are interested in applying for the next T-bill auction, you may follow our guide on how to buy T-bills.

If you plan to apply with CPF, you can estimate the additional interest you may earn using our CPF T-bill calculator.